Page 34 - 6727

P. 34

Economic Theory

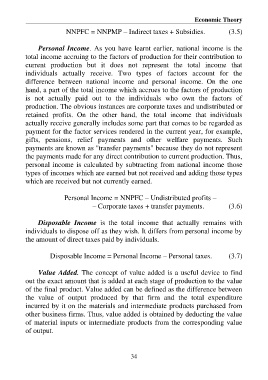

NNPFC = NNPMP – Indirect taxes + Subsidies. (3.5)

Personal Income. As you have learnt earlier, national income is the

total income accruing to the factors of production for their contribution to

current production but it does not represent the total income that

individuals actually receive. Two types of factors account for the

difference between national income and personal income. On the one

hand, a part of the total income which accrues to the factors of production

is not actually paid out to the individuals who own the factors of

production. The obvious instances are corporate taxes and undistributed or

retained profits. On the other hand, the total income that individuals

actually receive generally includes some part that comes to be regarded as

payment for the factor services rendered in the current year, for example,

gifts, pensions, relief payments and other welfare payments. Such

payments are known as "transfer payments" because they do not represent

the payments made for any direct contribution to current production. Thus,

personal income is calculated by subtracting from national income those

types of incomes which are earned but not received and adding those types

which are received but not currently earned.

Personal Income = NNPFC – Undistributed profits –

– Corporate taxes + transfer payments. (3.6)

Disposable Income is the total income that actually remains with

individuals to dispose off as they wish. It differs from personal income by

the amount of direct taxes paid by individuals.

Disposable Income = Personal Income – Personal taxes. (3.7)

Value Added. The concept of value added is a useful device to find

out the exact amount that is added at each stage of production to the value

of the final product. Value added can be defined as the difference between

the value of output produced by that firm and the total expenditure

incurred by it on the materials and intermediate products purchased from

other business firms. Thus, value added is obtained by deducting the value

of material inputs or intermediate products from the corresponding value

of output.

34