Page 33 - 6727

P. 33

Economic Theory

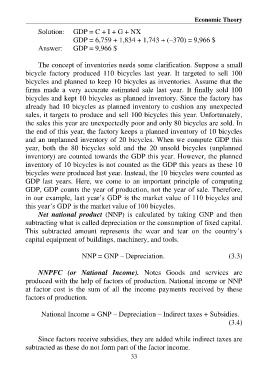

Solution: GDP = C + I + G + NX

GDP = 6,759 + 1,834 + 1,743 + (–370) = 9,966 $

Answer: GDP = 9,966 $

The concept of inventories needs some clarification. Suppose a small

bicycle factory produced 110 bicycles last year. It targeted to sell 100

bicycles and planned to keep 10 bicycles as inventories. Assume that the

firms made a very accurate estimated sale last year. It finally sold 100

bicycles and kept 10 bicycles as planned inventory. Since the factory has

already had 10 bicycles as planned inventory to cushion any unexpected

sales, it targets to produce and sell 100 bicycles this year. Unfortunately,

the sales this year are unexpectedly poor and only 80 bicycles are sold. In

the end of this year, the factory keeps a planned inventory of 10 bicycles

and an unplanned inventory of 20 bicycles. When we compute GDP this

year, both the 80 bicycles sold and the 20 unsold bicycles (unplanned

inventory) are counted towards the GDP this year. However, the planned

inventory of 10 bicycles is not counted as the GDP this years as these 10

bicycles were produced last year. Instead, the 10 bicycles were counted as

GDP last years. Here, we come to an important principle of computing

GDP, GDP counts the year of production, not the year of sale. Therefore,

in our example, last year’s GDP is the market value of 110 bicycles and

this year’s GDP is the market value of 100 bicycles.

Net national product (NNP) is calculated by taking GNP and then

subtracting what is called depreciation or the consumption of fixed capital.

This subtracted amount represents the wear and tear on the country’s

capital equipment of buildings, machinery, and tools.

NNP = GNP – Depreciation. (3.3)

NNPFC (or National Income). Notes Goods and services are

produced with the help of factors of production. National income or NNP

at factor cost is the sum of all the income payments received by these

factors of production.

National Income = GNP – Depreciation – Indirect taxes + Subsidies.

(3.4)

Since factors receive subsidies, they are added while indirect taxes are

subtracted as these do not form part of the factor income.

33