Page 162 - 6484

P. 162

manager to make the necessary changes and adjustments before major problems

develop.

Years ago, Success-R-Us experienced problems because its management style

was insufficiently proactive. A reactive manager waits to react to problems and then

solves them by crisis management. This type of manager goes from crisis to crisis

with little time in between to notice opportunities that may become available. The

reactive manager’s business is seldom prepared to take advantage of new

opportunities quickly. Businesses that are managed proactively are more likely to be

successful, and this is the result that Success-R-Us is experiencing since it instituted a

company-wide initiative to promote proactive controls.

Like most organizations, Success-R-Us uses computer software programs to do

record keeping and develop financials. These programs provide a chart of accounts

that can be individualized to the business and the templates for each account ledger,

the general ledgers, and the financial reports. These programs are menu driven and

user-friendly, but knowing how to input the data correctly is not enough. A manager

must also know where to input each piece of data and how to analyze the reports

compiled from the data. Widely accepted accounting guidelines dictate that if you

have not learned a manual record-keeping system, you need to do this before

attempting to use a computerized system.

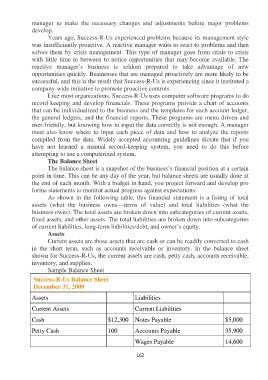

The Balance Sheet

The balance sheet is a snapshot of the business’s financial position at a certain

point in time. This can be any day of the year, but balance sheets are usually done at

the end of each month. With a budget in hand, you project forward and develop pro

forma statements to monitor actual progress against expectations.

As shown in the following table, this financial statement is a listing of total

assets (what the business owns—items of value) and total liabilities (what the

business owes). The total assets are broken down into subcategories of current assets,

fixed assets, and other assets. The total liabilities are broken down into subcategories

of current liabilities, long-term liabilities/debt, and owner’s equity.

Assets

Current assets are those assets that are cash or can be readily converted to cash

in the short term, such as accounts receivable or inventory. In the balance sheet

shown for Success-R-Us, the current assets are cash, petty cash, accounts receivable,

inventory, and supplies.

Sample Balance Sheet

Success-R-Us Balance Sheet

December 31, 2009

Assets Liabilities

Current Assets Current Liabilities

Cash $12,300 Notes Payable $5,000

Petty Cash 100 Accounts Payable 35,900

Wages Payable 14,600

162