Page 95 - 6727

P. 95

Economic Theory

Examples of hyperinflation include Germany in the 1920s, Zimbabwe in

the 2000s, and during the American Civil War.

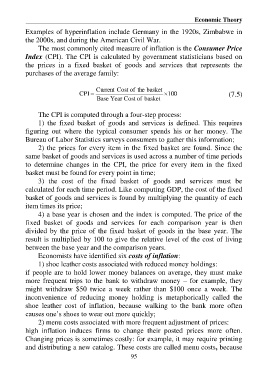

The most commonly cited measure of inflation is the Consumer Price

Index (CPI). The CPI is calculated by government statisticians based on

the prices in a fixed basket of goods and services that represents the

purchases of the average family:

Current Cost of the basket

CPI 100 (7.5)

Base Year Cost of basket

The CPI is computed through a four-step process:

1) the fixed basket of goods and services is defined. This requires

figuring out where the typical consumer spends his or her money. The

Bureau of Labor Statistics surveys consumers to gather this information;

2) the prices for every item in the fixed basket are found. Since the

same basket of goods and services is used across a number of time periods

to determine changes in the CPI, the price for every item in the fixed

basket must be found for every point in time;

3) the cost of the fixed basket of goods and services must be

calculated for each time period. Like computing GDP, the cost of the fixed

basket of goods and services is found by multiplying the quantity of each

item times its price;

4) a base year is chosen and the index is computed. The price of the

fixed basket of goods and services for each comparison year is then

divided by the price of the fixed basket of goods in the base year. The

result is multiplied by 100 to give the relative level of the cost of living

between the base year and the comparison years.

Economists have identified six costs of inflation:

1) shoe leather costs associated with reduced money holdings:

if people are to hold lower money balances on average, they must make

more frequent trips to the bank to withdraw money – for example, they

might withdraw $50 twice a week rather than $100 once a week. The

inconvenience of reducing money holding is metaphorically called the

shoe leather cost of inflation, because walking to the bank more often

causes one’s shoes to wear out more quickly;

2) menu costs associated with more frequent adjustment of prices:

high inflation induces firms to change their posted prices more often.

Changing prices is sometimes costly: for example, it may require printing

and distributing a new catalog. These costs are called menu costs, because

95